Not known Incorrect Statements About Insurance

Wiki Article

The Main Principles Of Life Insurance

Table of ContentsExamine This Report on Life InsuranceThe Ultimate Guide To Renters InsuranceHealth Insurance - The FactsThe Ultimate Guide To InsuranceThe 5-Second Trick For Renters Insurance

Constantly contact your employer first for readily available insurance coverage. If your employer does not use the sort of insurance you desire, get quotes from a number of insurance companies. Those who supply protection in multiple areas might supply some discount rates if you acquire greater than one kind of protection. While insurance is pricey, not having it could be much more costly.It really feels like a discomfort when you do not need it, yet when you do need it, you're freakin' glad to have it there (insurance). It's all regarding moving the risk right here. Without insurance, you could be one auto wreck, illness or emergency situation far from having a substantial cash mess on your hands.

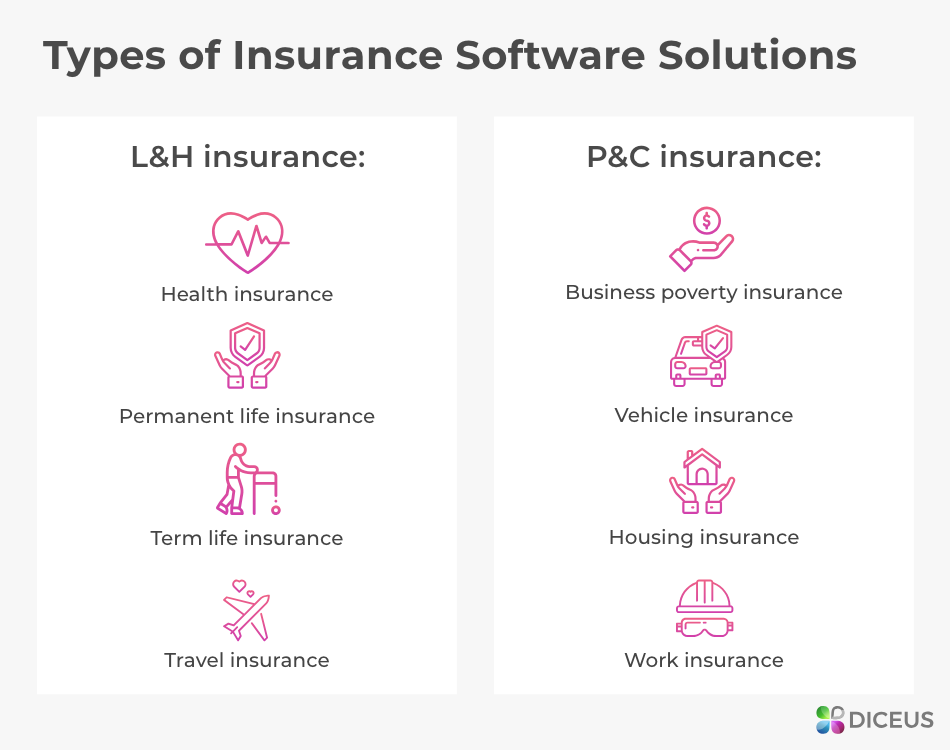

Not sure what the distinction is in between all of these? Have no fearwe'll break down whatever you require to find out about each of these sorts of insurance coverage. 1. Term Life Insurance Policy If there's only one type of insurance policy that you enroll in after reading this, make it call life insurance policy.

What Does Life Insurance Mean?

Assume about this: The more youthful you are, the more inexpensive term life insurance is. All that to claim, if it's something you think you might use in the future, it's cheaper to obtain it now than in 15 years.Automobile Insurance coverage You need to never ever drive around uninsurednot just since it's against the law yet likewise due to the fact that getting in a fender bender can be ex-pen-sive. The Insurance Details Institute states the average loss per case on vehicles is around $1,057.

Here's some additionals you might require to include: A lot of home owners don't know that flood insurance does not featured their regular plans. As well as flood insurance is also different than water backup protection. Is that green light as mud? A representative can aid you make sense of it all. If you do not live anywhere near our website a body of water, this insurance coverage isn't for you.

The Greatest Guide To Renters Insurance

Keep in mind, if you don't have wind insurance protection or a separate hurricane deductible, your home owners insurance coverage won't cover hurricane damage. Depending on where you live in the nation, earthquake coverage could not be consisted of in your home owners coverage. If you reside in a location where earthquakes are understood Source to shake things up, you may want to tack it on to your policy.Plus, a whole lot of landlords and houses will certainly need you to have occupants insurance policy also. An excellent independent insurance policy representative can stroll you via the actions of covering the essentials of both home owners and also renters insurance.

To help reduce back on the price of wellness insurance coverage, you might get a high-deductible health insurance strategy.

You can spend the funds you contribute to your HSA, and they grow tax-free for you to use currently or in the future. You can make use of the cash tax-free on competent medical expenditures like health insurance coverage deductibles, vision as well as oral. Some companies currently use high-deductible health strategies with HSA accounts in addition to standard medical insurance strategies.

Unknown Facts About Car Insurance Quotes

Insurance coverage offers assurance against the unexpected. You can discover a policy to cover nearly anything, yet some are more crucial than others. Everything depends upon your requirements. As you draw up your future, these 4 sorts of insurance policy need to be firmly on your radar. 1. Car Insurance coverage Automobile insurance policy is critical if you drive.Some states additionally need you to bring personal injury protection (PIP) and/or without insurance vehicle driver protection. These coverages spend for clinical expenses associated with the occurrence for you and also your travelers, despite who is at mistake. This likewise aids cover hit-and-run crashes as well as crashes with vehicle drivers who do not have insurance coverage.

If you don't get your own, your lending institution can purchase it for you as well as send you the expense. This may come with a higher expense and with much less coverage. House insurance coverage is an excellent concept even if you have actually paid off your home loan. That's since it guards you against costs for property damage.

In the event of a robbery, fire, or calamity, your occupant's plan need to cover many of the costs. It may also useful content help you pay if you have to stay somewhere else while your residence is being fixed. And also, like house insurance, occupants uses responsibility defense.

Examine This Report about Car Insurance Quotes

Stout told The Equilibrium in an email: "Not having insurance coverage can be economically devastating to families due to the high price of care." Health insurance bought through the Market can even cover preventative services such as injections, screenings, as well as some examinations. That means, you can maintain your health and wellness and wellness to fulfill life's demands.Report this wiki page